The FinTech Five – 21st July 2023

21 July, 2023

Welcome to the FinTech Five, where we take a fortnightly look at the best articles, news, insights and features from our FinTech Wales members.

1. de Novo Solutions Partners with Rookery Software to Enhance Tech Portfolio with Advanced Configuration Management Capability.

Pioneering tech company, de Novo Solutions, has formed a new strategic partnership with Rookery Software to use ConfigSnapshot, their leading Oracle E-Business Suite and Fusion Cloud Applications configuration automation and control platform, to enhance its tech portfolio.

In forming a new strategic partnership, de Novo Solutions will now be able to leverage the capability of ConfigSnapshot to enable organisations to document, compare, and manage their Oracle applications environments effectively – all through the power of automation.

As such, de Novo customers will now be able to significantly reduce the resources required for configuration management tasks, resulting in streamlined operations, increased efficiency, and cost savings.

Discussing the new strategic partnership, Mark Sweeny, Founder and CEO of de Novo Solutions, said:

“Effective configuration management is crucial for the smooth operation and optimisation of Oracle Cloud applications. By incorporating ConfigSnapshot into our solutions, we can help our customers to maximise the value derived from these applications, while enabling them to fully leverage the potential of Oracle Cloud applications.

2. Chartis Research Ranks LexisNexis Risk Solutions as Category Leader in Four Payment Risk Categories

Chartis Research has recognised LexisNexis® Risk Solutions as Category Leader in the Payment Risk Solutions 2023: Market and Vendor Landscape Report across four categories in the payment risk solutions space.

The four categories are: Overall Scoring, Card Payments, Alternative Payments and Account-to-Account Payments.

Category Leaders “combine depth and breadth of functionality, technology and content with the required organisational characteristics to capture significant share in their market,” according to the report.

“The LexisNexis Risk Solutions portfolio harnesses the capabilities necessary to confront the growing issue of risk exposure in current payment processes,” said Nick Vitchev, research director, financial crime and fraud markets, Chartis Research. “The seamless integration of products with existing verification systems and real time capabilities positions it as a Category Leader for global Payment Risk Solutions.”

The report uses Chartis RiskTech Quadrant®, a comprehensive methodology of in-depth independent research and a clear scoring system, to explain which technology solutions meet an organisation’s needs.

3. Monmouthshire Building Society Joins the Government’s Mortgage Charter

There has been lots of information about mortgages in the news recently, particularly after the most recent Bank of England bank rate increase on 22nd June 2023.

The government recently created a Mortgage Charter, for mortgage lenders to voluntarily sign up to. It offers commitments to people with residential mortgages to provide them with further support during this time.

Monmouthshire Building Society has joined this charter to make sure they continue to offer as much support and flexibility to those who may be in financial difficulty.

Click here to read more about Monmouthshire BUilding Society’s commitments to the Mortgage Charter.

4. Credas Find that Businesses risk falling foul of UK law as AML Interest is lagging.

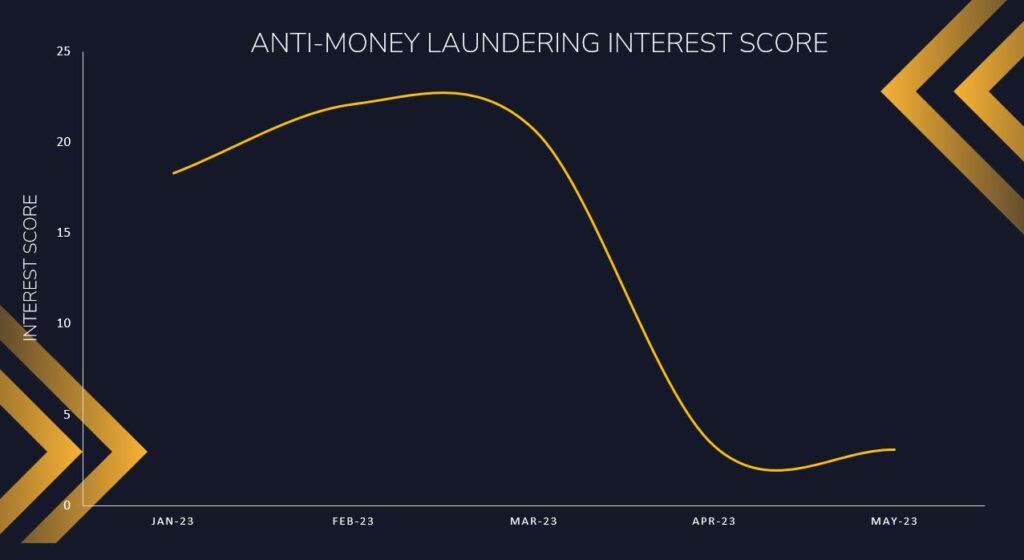

Research from Credas has revealed that interest in anti-money laundering has waned while regulatory fines have increased.

Credas’ analysis of internet search trends has revealed that ‘economic sanctions’ and ‘politically exposed persons’ are the most searched anti-money laundering (AML) term in the UK, however, overall search interest in AML related topics is on the slide when compared to the start of the year.

Credas analysed Google Trends data for nine search terms related to AML to see which has the highest Interest Score and is, therefore, of greatest concern to the nation. Interest Scores represent search interest relative to the highest point on the chart for the given region and time. A value of 100 indicates peak popularity for the term. A value of 50 means that the term is half as popular. And so on.

Among the nine search terms analysed, the phrase ‘economic sanctions’ currently has the highest Interest Score of 45.5.

This suggests that professionals who are required to adhere to UK laws around AML, such as estate agents, are keen to better understand which nations and organisations currently have sanctions against them, perhaps as a result of sanctions against Russian investors since the full-scale invasion of Ukraine.

Click here to read a full summary of Credas’ research findings.

5. Pepper Money Launches Specialist First Home Mortgages

Pepper Money has strengthened its Affordable Home Ownership proposition by becoming the first specialist lender to launch a dedicated proposition to support the First Homes scheme.

The First Homes scheme offers new build properties for a discount of at least 30% on the open market value, and local authorities have the discretion to set deeper minimum discounts of either 40% or 50% through local planning policy.

The government scheme is available on new-build homes and, until now, has only been supported by mainstream lenders. By launching First Homes, Pepper Money will be the first specialist lender to provide an option for Hopeful Homeowners whose circumstances fall outside of mainstream criteria.

Financial inclusion remains the guiding principle of Pepper Money which has a strong reputation in adverse credit. The expansion of their Affordable Home Ownership range complements their full range of specialist residential and second charge mortgage products.

Paul Adams, Sales Director at Pepper Money, says:

“At Pepper Money, we have a clear purpose, to deliver positive societal outcomes and promote greater financial inclusion to a more diverse range of customers. Our Affordable Home Ownership proposition plays a vital role in this, and we are committed to helping even more Hopeful Homeowners to achieve their dreams.

Until Next Time

That’s it for the FinTech Five this week. Thank you for reading, and don’t forget to join us fortnightly for more of the best news highlights from across our FinTech Wales membership.