The FinTech Five – 18th August 2023

18 August, 2023

Welcome to the FinTech Five, where we take a fortnightly look at the best articles, news, insights and features from our FinTech Wales members and the Financial Services industry in the UK.

1. FCA and the City of London Corporation announce launch event for the Authorised Push Payment (APP) fraud synthetic dataset

The FCA is co-hosting a 1-day in-person event in partnership with the City of London Corporation to launch the Authorised Push Payment (APP) fraud synthetic dataset. The event will be hosted on the FCA Permanent Digital Sandbox, from 09:00 to 17:00 on Wednesday 27 September, 2023.

Reflecting and building on the valuable lessons learned from the APP Fraud TechSprint, the FCA, COLC and Smart Data Foundry have continued to explore and enhance the synthetic dataset and are excited to announce this all-day event to reconvene the community and build on the APP Fraud sprint and plot the role for synthetic data.

Purpose of the event:

- Introduce the APP Fraud synthetic dataset and the engagement programme around it.

- Familiarise you with the synthetic data set as a potential innovative tool for data sharing challenges.

- Introduce the permanent Digital Sandbox.

Please visit the FCA’s website for further information about the event and to register to apply for a place. The registration deadline is COB 12 September 2023.

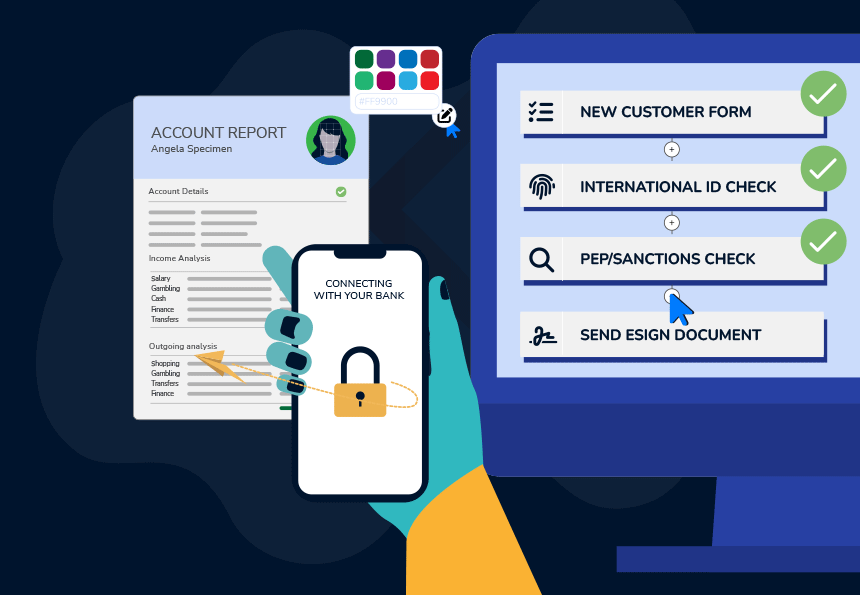

2. Credas Introduces Their New Next-Gen Platform – Credas 3.0

After more than three years of development and millions of pounds in investment, Credas have revealed the next generation of their sector-leading platform – Credas 3.0.

Credas’s brand new platform delivers a number of new innovations that will simplify due diligence for both businesses and their customers, while reducing the risk of fraudulent/criminal activity.

Property professionals and regulated businesses will be able to take advantage of Credas’s:

- New branding module offering full branding that includes emails, SMS, landing pages, PDF reports & web app. Available as standard across all packages.

- Free proof and source of funds module including document uploads.

- New Open banking capabilities for automated account analysis from as little as 45p.

- The new Credas workflow engine that can create bespoke processes in hours not days.

- New fully integrated UK eIDAS advanced eSignatures.

- New PEPS and Sanctions results that include headshots, daily ongoing monitoring, adverse media, and law enforcement.

- New customisable data capture forms for bespoke client onboarding processes.

Click here to read more about Credas 3.0

3. de Novo Solutions Shortlisted for 3 Prestigious ERP Industry Awards

Fast-growing digital transformation consultancy, de Novo Solutions dedicated to ‘re-imagining the world of work’ has been shortlisted by the prestigious ERP Today Awards in 3 different categories

Launched in 2021, de Novo Solutions are pioneers within the technology sector, specialising in the implementation and support of innovative Finance, HR and Payroll solutions. Committed to adding significant value to both private and public sector organisations through tailored tech solutions, de Novo Solutions has been nominated for ‘ERP Tech Innovation of the Year’, ‘HR Tech Innovation of the Year’ and one of its forward-thinking graduates also shortlisted for ‘Young Professional of the Year’.

Mark Sweeny, Founder and Chief Executive of de Novo Solutions, confirmed: “2023 has been an incredible year so far for de Novo Solutions, where we have not only launched new solutions in VaaS™ – our Managed Cloud Support ‘Value as a Service™’ offering – and Odyssea™ – an innovative cloud solution for Secondary Education – but we have also helped a number of organisations significantly improve processes and outcomes through our innovative and unique approach to market.

4. Finalrentals Expands Into Greece

Finalrentals has launched a master franchise in Greece, expanding the car rental company’s reach to 32 countries, the company announced recently.

Founder and CEO Ammar Akhtar hailed the new franchise as a major achievement, bringing the company closer to realizing its goal of serving 100 countries by 2025. “This exciting development highlights Finalrentals’ commitment to growth and success and emphasizes its dedication to serving customers worldwide,” he said in a news release.

Expanding into Greece, famous for its magnificent temples and historical legacy, will also solidifys the Finalrentals presence in the Balkans. The move comes after the company successfully operated in Croatia, Albania, Serbia, and Montenegro. Akhtar notes the franchise will continue Finalrentals’ reputation for exceptional car rental services, which includes the ability to search and compare rental car prices and receive instant confirmation.

Click here to read more about Finalrentals’ recent expansion.

5. AperiData joins forces with PayPoint

AperiData have joined forces with PayPoint plc, the innovative technology leader in payment and retail services. The collaboration marks a significant milestone in the evolution of the UK’s Open Banking offerings. It targets the modernisation of the dated Consumer Credit scoring market by blending in real time Open Banking data for financial assessments. This allows organisations to serve their customers digitally, more accurately and in real time, extending the reach of appropriate and affordable financial solutions into underserved communities.

The partnership is driven by the mutual commitment of AperiData and PayPoint to digitise the affordability calculations so needed in the UK, during the current cost of living crisis. The AperiData Credit Referencing and Open Banking capabilities embedded into PayPoint’s leading Payment services, gives clients more comprehensive financial insight, more paperless and streamlined operations, and ultimately improved consumer outcomes.

Click here to read more on the partnership.

Until Next Time

That’s it for the FinTech Five this week. Thank you for reading, and don’t forget to join us fortnightly for more of the best news highlights from across our FinTech Wales membership.