Lloyds Banking Group Launches 2023 Innovation Programme

07 March, 2023

FinTech Wales is delighted to support Lloyds Banking Group’s Launch Innovation Programme 2023.

There are four challenges for FinTech firms to enter, as well as an additional ‘Wild Card’ category. Read more about the Innovation Programme, the four challenges and how to apply below.

What is the Launch Innovation Programme?

Launch 2023 is a 12 week collaborative Innovation programme offering rapid experimentation with access to subject matter experts and free business masterclasses.

Successful applicants will work with subject matter experts and dedicated Launch Programme colleagues to refine and test value propositions to solve key strategic business challenges. These bespoke proposals will be pitched to the Challenge sponsors and senior leaders involved, giving applicants the chance to run a proof of concept in partnership with Lloyds Banking Group.

What’s the purpose of Launch 2023?

Lloyds Banking Group want to be:

- the best bank for FinTechs and InsurTechs to partner with

- the best bank for customers

now and in the future.

Who is it for?

Ambitious companies and individuals who can solve who can solve one of our four strategic business challenges, or are interested in our ‘Wild Card’ challenge.

The application window opens on the 7th of March and will close on the 21st of April.

The Programme will begin on the 15th of May and conclude on the 4th of August.

Apply Now

Launch Innovation Programme 2023 – Strategic business Challenges

1. Curating targeted Financial Planning and Added Value Services that meet customer needs

- Providing a customer focused ecosystem that provides more integrated, timely and personalised value to our current account, mortgage, saving and investment customers in their everyday lives

- Providing ancillary services to help customers with their travel, health and transport needs

- Proactive and engaging communication method(s) utilising gamification, nudges etc

- Retirement is not just about finances. How can we engage customers with solutions that support their needs whilst they plan and enjoy their retirement?

- What innovative ways can we explore to help customers achieve their retirement goals, whilst proving them with a clear view of wealth?

- Pension dashboard and ability for customers to transact more frequently online

- Differentiate the proposition in the Intermediary Protection market with added value services

-

- Enhance the claims process to help customers get what they need through a frictionless and efficient journey

- Remote loss assessment technology, augmented reality

- Improve existing customer experiences (alternate payment methods, chat services, connected home technology)

- Deepening relationships with customers with event streaming from payments (i.e. pay something expensive we give a real-time quote to take out/ adapt insurance policy/ premium)

- Personalised messaging to customers (pro-active support, offer new services, support)

- Using digital services and technology to better support the financial life ambitions of our mass affluent customers (income or wealth above £75,000)

- Going beyond the basics of personal financial management tools (PFMs) with more sophisticated ways to manage money across multiple asset classes, providing engaging, insightful, action oriented content inspiring customers to lead better financial lives

- Supporting our customer’s legacy planning needs

- Enhance the claims process to help customers get what they need through a frictionless and efficient journey

Apply Now

2. Harnessing Data to enrich our Customer Relationships

- Using our data, and new sources of data, to better serve and engage our customers

- ensuring the interactions we have with our customers are relevant and add value

- encouraging our customers to be more engaged with their financial lives

- encouraging our customers to be more engaged throughout their policy lifetime, particularly younger segments

- inspiring customer loyalty

- Sharing the right content at the right time with our customers

- optimising data to enable meaningful personalisation

- Leveraging additional Open Finance opportunities

- Delivering more accurate pricing models incorporating new data sources

- Harnessing AI and machine learning to improve workflow and reduce manual processing

- Adviser client engagement – charting and visualisation of data to support customer retirement conversations

Apply Now

3. Providing the most Inclusive Colleague and Customer Experiences

- Enhance our customer digital experience including

- providing holistic advice, content and tools to support our customer’s financial wellbeing

- filling the advice gap for customers with smaller pension pot valuations

- going beyond education to provide everyday digital support to our customers

- Putting customers and colleagues in control with a seamless online appointment booking system

- Supporting customers who are showing early signs of financial distress

- Helping our customers to navigate the cost of living crisis

- Giving our colleagues the tools to best support our customers

- introducing a Customer Service Workspace solution to provide Customer 360 View and journey execution

- helping colleagues access the correct support material for customers with complex problems in the most effective way (e.g. AI, Chat Tech)

- Enhancing the capability of our telephony channel

- fulfilling telephone demand

- triaging and routing calls more effectively

- improving our view of interactions to reduce failure demand

- Create a developer and engineering system that provides the optimum experience and community to deliver change

Apply Now

4. Exploring Sustainable choices for our customers and our IT Operations

- Supporting and/or rewarding customers for sustainable choices and actions

- Developing more sustainable home insurance claims processes – replacement of goods, supplier selection

- Proactively reduce our customers flood risk

- Helping customers who are interested in retro-fitting or refurbishing their homes

- Identifying opportunities to make out technology estate and change delivery process more sustainable

Apply Now

Wild Card

If you have a proposition that you think would be great for Lloyds Banking Group but doesn’t fit with these business challenges, we would still love to hear from you! Please share any useful details with us through our ‘Wild Card’ theme.

Applications under this theme will not be considered for the Launch programme, but will be reviewed by a member of the wider FinTech Investment team who will get in touch if we’re interested to know more. Unfortunately we can’t guarantee individual feedback to applications in this category.

Apply Now

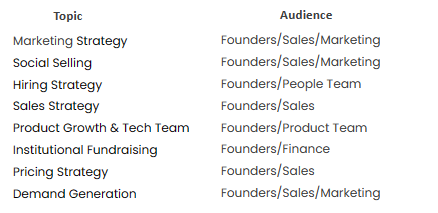

Launch Innovation Masterclasses 2023

As part of the Launch Programme, companies have access to masterclasses, that deliver expertise and advice to founders and wider teams to fuel individual and business growth

The sessions have been delivered to hundreds of high growth businesses from Seed to Series C, by experts across Sales, Marketing, Hiring, Fundraising and Ops, to help teams scale quicker

Most sessions will last for 1 hour.

All sessions are recorded and accessible at a later date should you need

The masterclass speakers are also available for 1:1 support if you would benefit from some follow on activity